Form 16 is a crucial document for every salaried employee in India. It contains important details such as the salary earned and the tax deducted at source (TDS) by the employer on behalf of the employee. This document is crucial for ensuring tax compliance and is used for filing income tax returns.

However, interpreting Form 16 can be a challenging task for many. In this guide, we will explain the components of Form 16 and provide tips on how to read and interpret it with ease. If you’re a salaried employee this guide will help you navigate the complexities of Form 16 and ensure that you comply with tax regulations.

I. Understanding the Basics of Form 16

A. What is Form 16?

Form 16 is a document that contains important information about the salary earned by a salaried employee and the tax deducted at source (TDS) by their employer. It is issued annually by the employer and is used for filing income tax returns.

B. Components of Form 16

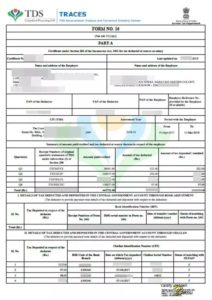

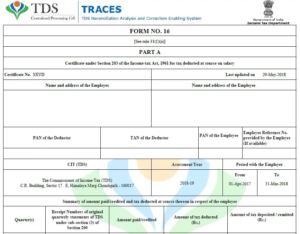

Form 16 consists of two parts – Part A and Part B. Part A contains details of the employer and employee, such as name, address, PAN, TAN, and the period of employment. Part B provides details of the salary earned and the tax deducted by the employer. It includes the breakup of the salary, allowances, deductions, and exemptions claimed by the employee.

II. How to Read and Interpret Form 16

A.Part A of Form 16

Part A of Form 16 is a certificate issued by the employer, and it contains the following details:

Name and Address of the Employer:

This section of Part A contains the name and address of the employer who has deducted tax at source (TDS) from the salary of the employee.

PAN of the Employer: This section contains the Permanent Account Number (PAN) of the employer.

TAN of the Employer: This section contains the Tax Deduction and Collection Account Number (TAN) of the employer.

Name and Address of the Employee: This section contains the name and address of the employee who has received the salary from the employer.

PAN of the Employee: This section contains the Permanent Account Number (PAN) of the employee.

Period of Employment: This section contains the duration of the employment period for which the Form 16 has been issued.

Part A is an important part of Form 16 as it provides the necessary details to verify the TDS deductions made by the employer. It is essential to check the accuracy of the information provided in Part A.

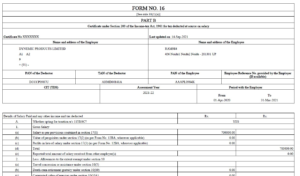

B. Part B of Form 16

Part B of Form 16 is the section that provides details of the salary earned by the employee and the tax deducted by the employer. It includes the following details:

Gross Salary: This section contains the total salary earned by the employee during the financial year.

Allowances: This section contains the details of the allowances received by the employee, such as House Rent Allowance (HRA), Dearness Allowance (DA), and Travel Allowance (TA).

Deductions: This section contains the details of the deductions claimed by the employee, such as Provident Fund (PF), National Pension Scheme (NPS), and Life Insurance Premium.

Tax Deducted at Source (TDS): This section contains the details of the tax deducted by the employer on behalf of the employee.

Taxable Salary: This section contains the net salary earned by the employee after deducting the allowances and deductions from the gross salary.

Income Tax Calculation: This section contains the details of the income tax calculated on the taxable salary.

Understanding how to read and interpret Part B of Form 16 is crucial for filing accurate income tax returns. It is essential to check for any discrepancies or errors in the details provided in Part B. Any discrepancies or errors should be brought to the attention of the employer for rectification before filing the income tax return.

III. Filing Tax Returns with Form 16

A. Using Form 16 to File Tax Returns

Form 16 is an essential document that salaried employees receive from their employers each year. It contains details of the salary received, the tax deducted, and other relevant information. Using Form 16 to file tax returns can make the process easier and more streamlined. Here is a step-by-step guide on how to file tax returns using Form 16:

Register on the Income Tax e-filing website: To file your tax returns, you need to register on the Income Tax e-filing website. You can do this by visiting the website and following the registration process.

Gather necessary documents such as Form 16 and PAN card: Before you start filing your tax returns, ensure that you have all the necessary documents at hand. This includes your Form 16, PAN card, and other relevant documents.

Download the relevant tax return form: Based on your income and other criteria, you need to download the relevant tax return form. This can be done from the Income Tax e-filing website.

Fill in the necessary details and verify the form: Once you have downloaded the form, fill in the necessary details such as your personal information, income details, tax deductions, etc. Ensure that you verify the form before submitting it.

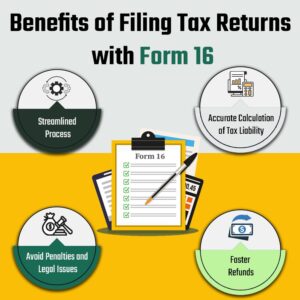

B. Benefits of Filing Tax Returns with Form 16

There are several benefits of filing your tax returns with Form 16. Some of the main benefits include:

Easy and streamlined process: Filing tax returns with Form 16 can make the process easier and more streamlined. It contains all the necessary information and reduces the need for additional documents and paperwork.

Accurate calculation of tax liability: Form 16 contains details of the tax deducted by your employer. This makes it easier to calculate your tax liability accurately.

Faster refunds: If you are eligible for a tax refund, filing your tax returns with Form 16 can ensure that you receive your refund faster.

Avoid penalties and legal issues: Filing tax returns on time and with accurate information can help you avoid penalties and legal issues.

Form 16 is a crucial document for salaried employees in India as it provides a detailed summary of their salary, tax deductions, and TDS payments. Understanding the basics of Form 16, reading and interpreting it correctly, and filing tax returns using it can save you from the hassles of taxation.

At Taxpuram, we understand the importance of financial and accounting support for businesses. Our team of experts provides top-notch services ranging from business registration, tax filings, licenses, trademark, and copyright registration to the development of your business. We are committed to providing excellent service at an economically viable cost. If you need any assistance with your financial matters, do not hesitate to contact us.

FAQs:

What happens if I do not file my tax returns with Form 16?

Failing to file your tax returns can lead to penalties and legal consequences. Form 16 provides accurate details of your income and tax deductions, which can help you avoid any discrepancies in your tax returns.

Can I file my tax returns without Form 16?

Yes, you can file your tax returns without Form 16. However, it can be challenging to calculate your accurate tax liability without it.

Can Form 16 be used for multiple employers?

No, Form 16 can only be used for a single employer. If you have worked for multiple employers in a financial year, you will need Form 16 from each of them.

Can I file my tax returns without Form 16 if my income is below the taxable limit?

No, you are not required to file your tax returns if your income is below the taxable limit. However, if your income exceeds the threshold, you need to file your tax returns.

How can Taxpuram help me with my financial matters?

At Taxpuram, we provide a range of financial and accounting support services to businesses. Our team of experts can help you with business registration, tax filings, licenses, trademark, and copyright registration, among other services. Contact us for further assistance.

Recent Posts

- Birla Corp allocates rs.400 crore for cement grinding unit in Prayagraj, Uttar Pradesh

- Karnataka government is looking into a potential partnership with Meta to improve cyber safety.

- Air India and Alaska Airlines Partner to Offer Seamless Passenger Connections to 32 North American Destinations

- India Achieves Record Car Sales in October, Witnessing 16.3% Year-on-Year Growth with 391,472 Units Sold

- YouTube now requires users to either pay for Premium or watch ads, as ad blockers are blocked.

Recent Comments