In the era of digitalization every enterprise be it a government or a private enterprise is now switching over to the technological applications for faster processing and better accuracy of results. One among in the line of such transformation by the Government of India is the creation Instant PAN.

It may be recalled that in the Union Budget, 2020, Finance Minister Smt. Nirmala Sitharaman had announced to launch instant PAN facility to enable faster allotment of PAN through a series of simplified process. Trials began from February 2020 and on 28th May 2020 the Government of India have formally started the operations of generating instant PAN through Aadhar. This facility is made available in the E-Filing website of the Income Tax department. With the turnaround time of less than 10 minutes more than 6 Lakh PAN applications under this scheme have been processed till date.

Earlier, to obtain a PAN you have to manually submit an application and it might take days till you get an allotment of PAN. On the other hand if any discrepancies are found your application might get rejected and one needs to restart the same process of application. Even after the allotment, problems arose such as name mismatch, number mismatch etc. when linking of PAN and Aadhar was made mandatory by the government.

The scheme of instant PAN has redefined the process of obtaining the PAN. The process of obtaining the PAN is simplified to the extent that mere Aadhar details will get you a PAN allotment.

How to get PAN allotment under this INSTANT PAN

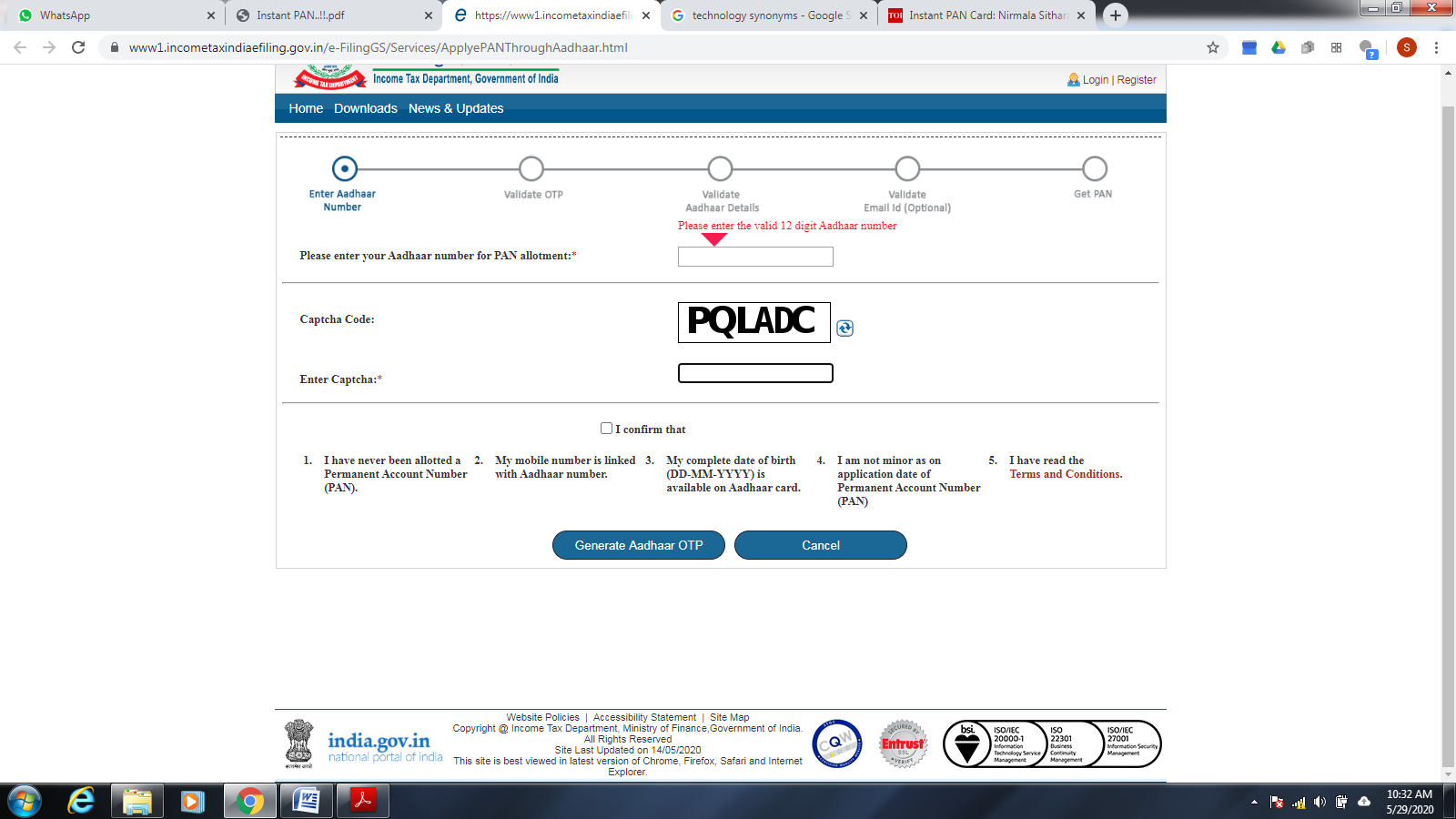

a. Go to https://www1.incometaxindiaefiling.gov.in/eFilingGS/Services/ApplyePANThroughAadhaar.html

b. Enter your 12 digit Aadhar Number and confirm

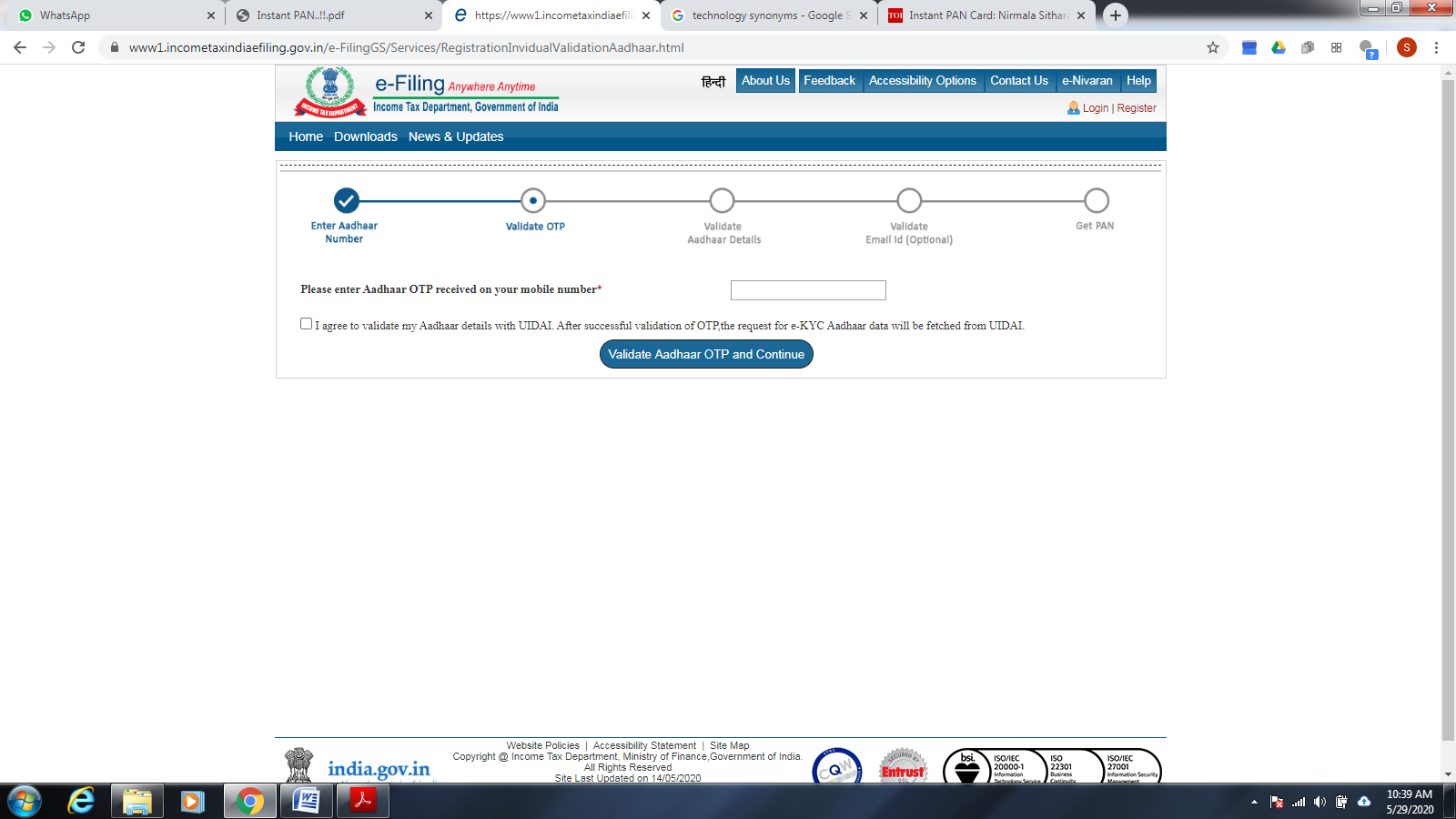

3. Validate the OTP sent to your registered Mobile Number.

Note: Please make sure that your Aadhar is seeded with your registered mobile number. In case if your Aadhar number is not seeded or updated then you can contact the nearest post office or designated banks or a common services center to update your details.

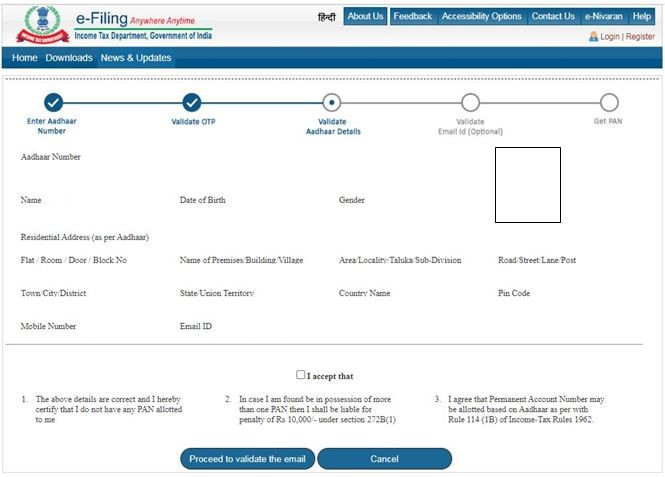

4. Validate your Aadhar details. Please check if the details mentioned in the Aadhar is correct or not. If any update is necessary to be made in the Aadhar, you can contact the nearest post office or designated banks or common services center to update your details

5. After the validation of your Aadhar details, this is an optional step wherein you can validate your email address which can help you to get communications from Income tax department. If you do not wish to validate your e mail address you can proceed to submit the application.

6. Once you click the submit button you will get an 15 digit acknowledgement number which will show your status of the application. Once your PAN gets approved you will receive a mail confirmation as well as text confirmation for the same

Recent Posts

- Birla Corp allocates rs.400 crore for cement grinding unit in Prayagraj, Uttar Pradesh

- Karnataka government is looking into a potential partnership with Meta to improve cyber safety.

- Air India and Alaska Airlines Partner to Offer Seamless Passenger Connections to 32 North American Destinations

- India Achieves Record Car Sales in October, Witnessing 16.3% Year-on-Year Growth with 391,472 Units Sold

- YouTube now requires users to either pay for Premium or watch ads, as ad blockers are blocked.

Recent Comments