Taxation is when a taxing authority, usually a government, levies or imposes a financial obligation on its citizens or residents. Paying taxes to governments or officials has been a mainstay of civilization since ancient times. Taxes are mandatory contributions levied on individuals or corporations by a government entity—whether local, regional, or national. Tax revenues finance government activities, including public works and services such as roads and schools or Social Security and Medicare programs.

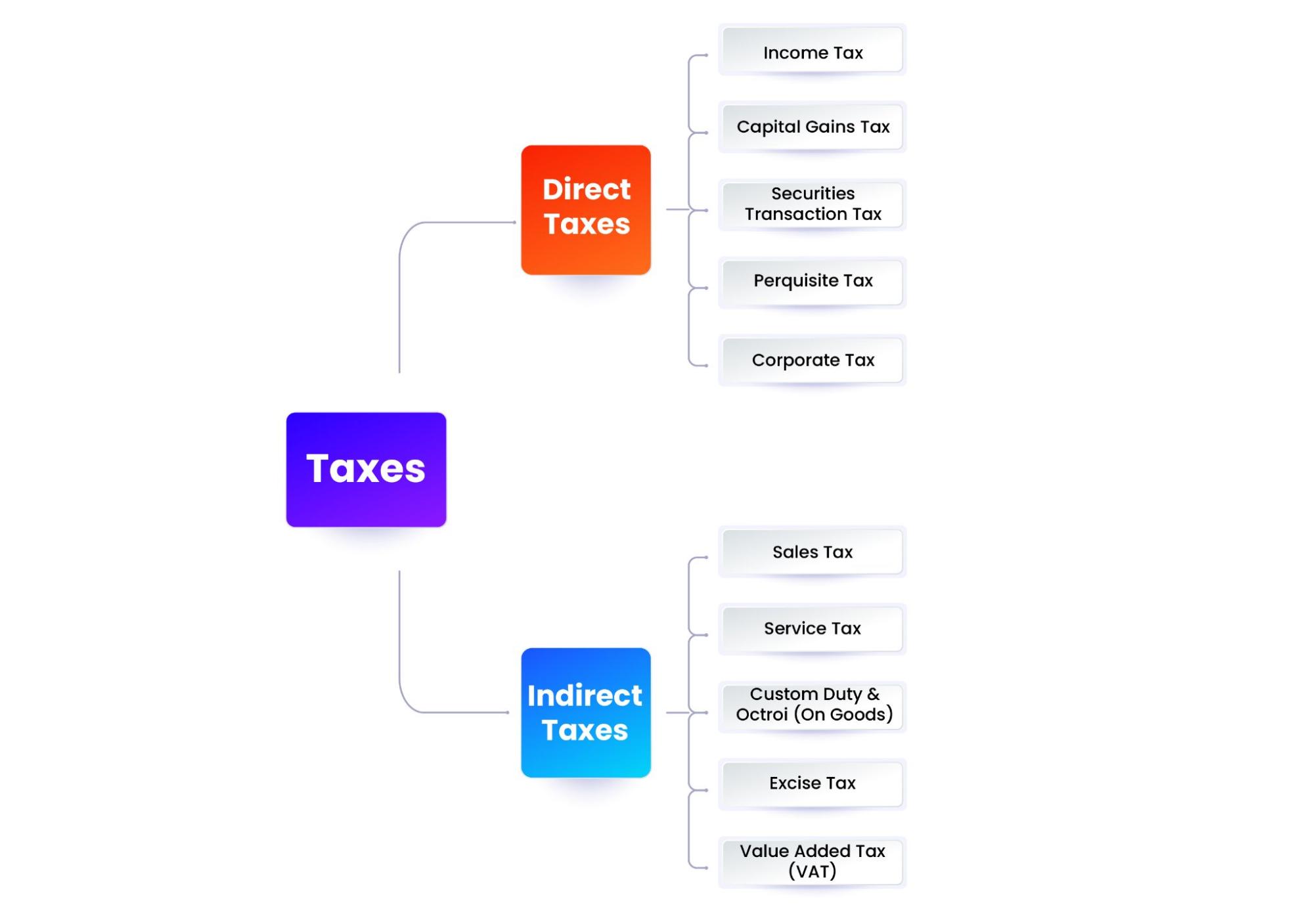

Types of taxes:

- DIRECT TAX:

In case companies are earning less than Rs. 1 crore, a corporate tax of 41.2% is levied. The corporate tax includes 40% basic tax and 3% education cess.

New Income Tax Slab for Individuals.

| Income Tax Slab | Tax Rate |

| From Rs.7,50,001 to Rs.10,00,000 | 15% of the total income that is more than Rs.7.5 lakh + 4% cess |

- INDIRECT TAX:

Unlike direct taxes, indirect taxes are levied on goods and services, not individual payers, and collected by the retailer or manufacturer. Sales and Value-Added Taxes (VATs) are two examples of indirect taxes.

Examples:

- Sales Taxes.

- Excise Taxes.

- Value-Added Taxes (VAT)

- Gross Receipts Tax.

Difference between New tax Vs Old tax Regime:

| Old Tax Regime (in INR) | New Tax Regime (in INR) | |

| Income from Salary | 20,00,000 | 20,00,000 |

| Less: Exemption for HRA | 1,20,000 | Not applicable |

| Less: Exemption for LTA | 50,000 | Not applicable |

| Less: Standard Deduction | 50,000 | 50,000 |

| Less: Deduction under Section 80C for PF | 150,000 | Not applicable |

| Net taxable Income | 16,30,000 | 20,00,000 |

| Tax on the above | 3,13,560 | 2,94,400 |

New Tax Regime:

The lower tax regime for individuals was introduced in 2020 under Section 115BAC as a simpler alternative, without claiming any investment-related deductions or exemptions. This was expected to prove useful for individuals who were not in a position to invest and claim deductions. The new regime had more slabs than the previous one. The new income tax regime was introduced in 2020 and was aimed at reducing exemptions and easing the compliance burden. The revised new tax regime offers a higher tax exemption, raises the threshold for tax rebate and reduces the surcharge for the super rich.

Finance Minister Nirmala Sitharaman proposed to reduce the number of tax slabs under the clutter-free New Tax Regime from six to five. The revised tax slabs under the new regime will be applicable for Assessment Year (AY) 2024-25 or for the income made in FY 2023-24. For income in FY 2022-23 (AY 2023-24), you will have to file Income Tax Return as per the old tax slabs.

As per the latest tax slabs under the New Regime, individuals having an annual income of Rs 5-6 lakh will have to pay 5% tax while those earning Rs 6-9 lakh will have to pay 10% of their income as tax. Further, individuals earning Rs 9-12 lakh per year will pay 15% tax while those earning Rs 12-15 lakh annually will pay 20% tax. The tax rate for individuals earning more than Rs 15 lakh will pay 30% tax.

New Tax Regime Excemption Available:

Thus, persons in the new tax regime, with income up to Rs 7 lakh will not have to pay any tax,” Nirmala Sitharaman said in the budget speech. “This will provide major relief to all taxpayers in the new regime. An individual with an annual income of Rs 9 lakh will be required to pay only Rs 45,000.

List of Exemptions & Deductions Not Allowed Under the New Tax Regime:

- House rent allowance, based on the rent payments and salary structure

- Special allowances under Section 10(14), except for the one mentioned above

- Tax deduction under Section 35(1)(ii), 35(2AA), 32AD, 33AB, 35(1)(iii), 33ABA, 35(1)(ii), 35CCC(a), and 35AD of the IT Act

- The option to adjust the unabsorbed depreciation of previous years

- Business professionals and owners in the Special Economic Zone cannot claim tax exemption under Section 10AA.

- Deductions on professional tax and entertainment allowance (applicable for government employees)

Recent Posts

- Birla Corp allocates rs.400 crore for cement grinding unit in Prayagraj, Uttar Pradesh

- Karnataka government is looking into a potential partnership with Meta to improve cyber safety.

- Air India and Alaska Airlines Partner to Offer Seamless Passenger Connections to 32 North American Destinations

- India Achieves Record Car Sales in October, Witnessing 16.3% Year-on-Year Growth with 391,472 Units Sold

- YouTube now requires users to either pay for Premium or watch ads, as ad blockers are blocked.

Recent Comments